Table Of Content

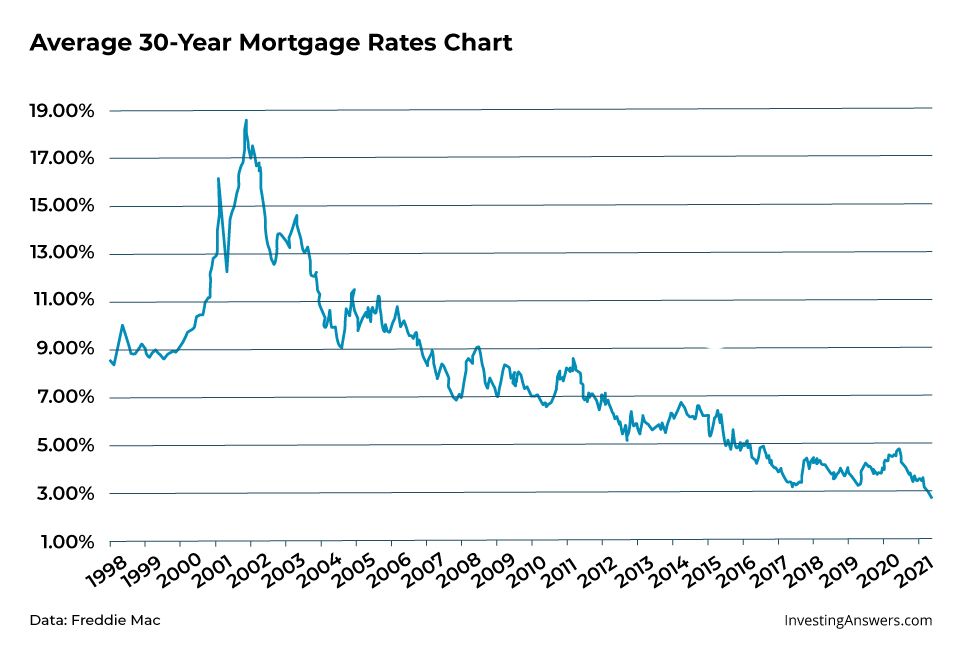

According to myFICO, borrowers with a score of 700 or higher could still get a rate in the 6% range, while those with scores in the low 600s may pay over 8% to get a mortgage. Average 30-year mortgage rates surpassed 7% this week, according to Zillow data. Rates have been ticking up in recent weeks due to hot economic data casting doubts on when the Federal Reserve will finally start lowering the federal funds rate. Rates on unusually small mortgages — a $50,000 home loan, for example — tend to be higher than average rates because these loans are less profitable to the mortgage lender. As the year concluded, the average mortgage rate went from 2.96% in 2021 to 5.34% in 2022.

Today’s rates for specific kinds of mortgages

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole. The 30-year fixed-rate mortgage is the most common type of home loan. With this type of mortgage, you'll pay back what you borrowed over 30 years, and your interest rate won't change for the life of the loan.

When you should lock your mortgage rate

It will often have a higher interest rate than a 15-year mortgage, but you’ll have a lower monthly payment. Since mortgage rates fluctuate for many reasons -- supply, demand, inflation, monetary policy and jobs data -- homebuyers won’t see lower rates overnight, and it’s unlikely they’ll find rates in the 2% range again. A smaller down payment doesn't always mean you'll have to settle for a higher rate, though. The interest rates for low down payment loans (like an FHA loan or a VA loan) can be very competitive. But if you make a down payment that's less than 20%, you'll probably have to pay for private mortgage insurance until you have at least 20% equity in the home, and that will increase your monthly cost. Be careful not to confuse interest rates and APR — both are expressed as a percentage, but they’re very different.

Top offers on Bankrate vs. the national average interest rate

For example, with a credit score of 580, you may qualify only for a government-backed loan such as an FHA mortgage. FHA loans have low interest rates, but come with mortgage insurance no matter how much money you put down. As the Federal Reserve continues its battle against inflation and edges closer to reaching its 2% target, mortgage rates have continued to indirectly climb higher. Since the Federal Reserve began its rate hikes in March 2022, the benchmark interest rate has risen 5 percentage points. In 2018, many economists predicted that 2019 mortgage rates would top 5.5 percent.

Real estate news: 30 remodeled Westminster apartments fetch $10 million

A competitive mortgage rate currently ranges from 6% to 8% for a 30-year fixed loan. Several factors impact mortgage rates, including the repayment term, loan type and borrower’s credit score. The standard 30-year fixed rate mortgage is benchmarked off the 10-year U.S. The spread reflects the "cost" of the mortgage to an investor based on the risks that the borrower could prepay their loan down the road or default on the loan in the future. These costs rise and fall with general economic conditions, including the prevailing interest rate environment causing rates to rise and fall according to changes in the risk of these loans to investors. Market demand and supply forces are drivers of mortgage rates, as well.

Mortgage demand drops as interest rates soar over 7% - CNBC

Mortgage demand drops as interest rates soar over 7%.

Posted: Wed, 24 Apr 2024 11:00:01 GMT [source]

The average mortgage rate for a 30-year fixed is 7.12%, nearly double its 3.22% level in early 2022. If you’re considering refinancing to lower your monthly payment, keep in mind that not all options yield less interest over the life of the loan. For the week ending April 25, the average 30-year fixed mortgage rate stood at 7.17%, according to Freddie Mac. Once the Fed starts lowering its benchmark rate, mortgage rates should trend down. But investors don't expect that to happen until the Fed's September meeting, according to the CME FedWatch Tool. If inflation remains elevated, we may need to wait even longer for rates to go down.

Pre-approvals aren't always a firm commitment to lend, but generally, if nothing in your financial situation or credit history changes, there's a good chance you'll get a green light when you apply. You need to apply for mortgage preapproval to find out how much you could qualify for. Lenders use the preapproval process to review your overall financial picture — including your assets, credit history, debt and income — and calculate how much they’d be willing to lend you for a mortgage. Mortgage points represent a percentage of an underlying loan amount—one point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when they’re initially offered the mortgage.

Mortgages

The current average mortgage rate on a 30-year fixed mortgage is 7.57%, according to Curinos. The average rate on a 15-year mortgage is 6.79%, while the average rate on a 30-year jumbo mortgage is 7.55%.Current Mortgage Rates for April 15,... The current average mortgage rate on a 30-year fixed mortgage is 7.65% with an APR of 7.67%, according to Curinos. The 15-year fixed mortgage has an average rate of 6.86% with an APR of 6.89%. The current average interest rate on a 30-year, fixed-rate jumbo mortgage is 7.61%— 0.08 percentage point up from last week. The 30-year jumbo mortgage rate had a 52-week APR low of 5.00% and a 52-week high of 10.50%.

First, you don’t need to make a down payment in most situations. Second, borrowers pay a one-time funding fee but don’t pay an annual fee as the FHA and USDA loan programs require. Today’s average rate on a 30-year mortgage (fixed-rate) rose to 7.65% from 7.57% yesterday. Currently, the average interest rate on a 30-year fixed mortgage is 7.65%, compared to 7.49% a week ago. Lenders call it “risk-based pricing.” A higher credit score indicates a lower risk that you’ll default on a loan — so you get a better interest rate. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

In December 2022, the Federal Reserve made the decision to dial down the pace of interest rate hikes, cutting the fed funds rate by only 50 basis points (0.50%). This trend of dialing back has persisted into 2023, evidenced by four adjustments of 25 basis points (0.25%) in January, March, May, and late July. As a result, the current federal funds rate now sits in a range of 5.25% to 5.50%. To understand today’s mortgage rates in context, take a look at where they’ve been throughout history. With Federal Reserve voting to hold the federal funds rate steady in January and inflation heading closer to target, three rate cuts appear to be on the menu in 2024.

Home values are constantly changing depending on buyer demand and the local market. Contact a California lender to learn more about local requirements for mortgages. A mortgage rate lock means that for a period of time, you'll get that interest rate even if market rates change before your loan closes. A 30-year fixed-rate mortgage has a 30-year term with a fixed interest rate and monthly principal and interest payments that stay the same for the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that will remain the same for an initial fixed number of years, and then adjusts periodically for the remainder of the term.

Based in New York, Katherine graduated summa cum laude from Colgate University with a bachelor's degree in English literature. This will give you an idea of the type of house you can afford. A good place to start is by using a mortgage calculator to get a rough estimate.

While mortgage rates change daily, it’s unlikely we’ll see rates back at 3 percent anytime soon. If you’re shopping for a mortgage now, it might be wise to lock your rate when you find an affordable loan. If your house-hunt is taking longer than anticipated, revisit your budget so you’ll know exactly how much house you can afford at prevailing market rates. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also rose this week, lifting the average rate to 6.44% from 6.39% last week.

No comments:

Post a Comment